At What Cost? The Impact of Diabetes on Your Budget, Part 1

Editor’s Notes:

- People who take insulin require consistently affordable and predictable sources of insulin at all times. If you or a loved one are struggling to afford or access insulin, you can build custom plans based on your personal circumstances through our tool, GetInsulin.org.

- For privacy purposes, all people included in our budget series will be anonymous. All budget numbers are self-reported.

- If you’re open to anonymously sharing your budget as part of this series, please reach out to editor@beyondtype1.org.

In this new series, we’re digging into the impact that living with type 1 diabetes has on your money.

We know this looks drastically different from person to person, depending on your health insurance coverage, your earnings, your ability to qualify for patient assistance programs and more. Then there’s the rest of life—student loans, childcare, transit costs, groceries, rent and more.

We also know there are things that can’t be quantified—the amount of time and energy anyone impacted by type 1 diabetes (T1D) has to spend navigating the healthcare system, health insurance companies, the amount of time and energy it takes to manage T1D and more.

So over the coming months, we’re asking people who are living with type 1 diabetes to share what their budget looks like.

First up, one month in Pembroke, New Hampshire on a $44,000 annual salary, with type 1 diabetes.

Overview

Age: 43, diagnosed with type 1 diabetes at 37

Location: New Hampshire

Occupation: Medical office manager

Annual Income: $44,000

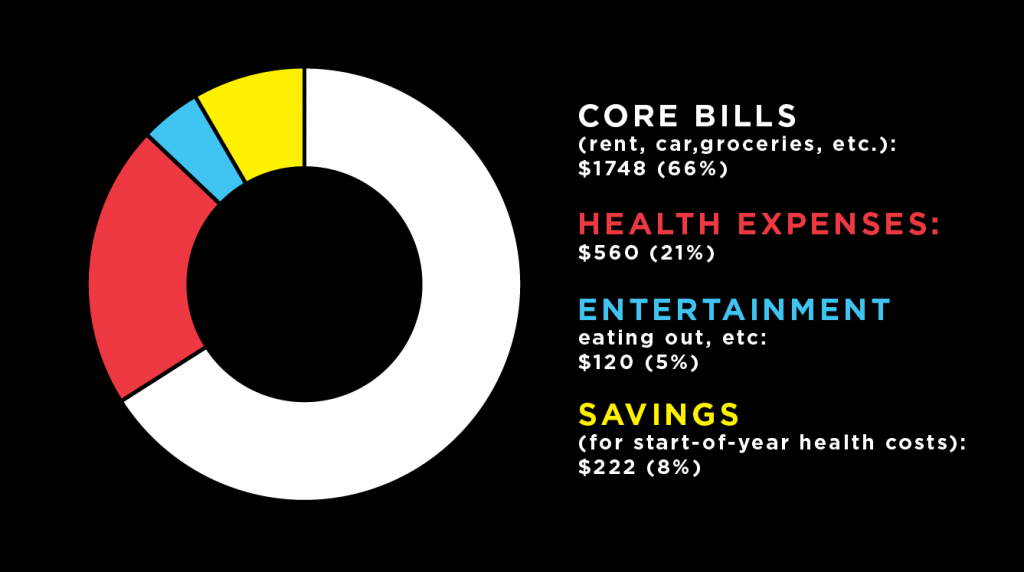

Monthly Budget

Core Expenses:

Take home pay, after taxes: $2,650

Rent: $500

Utilities, incl. gas, electricity, water, internet, cell phone, etc.: $489

Student loans: $100

Car, incl. Payment, insurance, gas, etc.: $399

Additional transit costs: $60

Groceries: $200

Health Expenses:

Health Insurance Plan: Harvard Pilgrim Health Care of New England Best Buy HMO – LP

- Deductible (Individual): $5,000

- Out of Pocket Maximum (Individual): $6,500

- Durable Medical Equipment coverage: $100 deductible, then 20 percent coinsurance; no charge for blood glucose monitors (not including continuous glucose monitors (CGMs)) or insulin pumps

- Prescription drug coverage (run through Optum Rx) for Tier 3 insulin: 30 percent coinsurance, up to $300 maximum per prescription or refill for a 30-day supply

Health Insurance Premium (portion paid by individual): $189

Insulin: $120

Blood Sugar Monitoring: $150 for Dexcom supplies

Insulin Pump Supplies, Additional Prescriptions, and Doctor’s Visits: $190

Credit Card Payments: $100

Disposable Income Expenses:

Self care (salon, barber, nail salon, etc.): $20

Eating out + coffee: $50

Clothing: $20

Entertainment: $30

Savings Contribution:

401(k): 3 percent

Editor’s Notes:

- Because the $189 health insurance premium is taken out of our subject’s paycheck before they receive it, it is not included in the pie chart above

- Under this health insurance plan, one brand of rapid acting insulin is listed as Tier 2 coverage, while another is listed as Tier 3. This is common, and changes the amount of out of pocket costs drastically based on the brand of insulin needed.

- We have chosen to include our subject’s credit card payments under their health expenses because their credit card bills were accumulated right after initial diagnosis, when previous insurance was not yet covering insulin, initial out of pocket expenses hit, etc.

The Backstory

Diagnosis

I was misdiagnosed with type 2 diabetes in November of 2013. I hadn’t been feeling well, so my friend who had diabetes checked my blood sugar, which was in the 300s. She told me I needed to go to the emergency room. They diagnosed me with type 2 diabetes; when I asked them if it could be any other type of diabetes they said, “nope, you’re 37.” The hospital was going to admit me but I didn’t have health insurance at the time, so they didn’t.

I was on metformin for two months, going to a local clinic for my care. When they tested my A1c, it was 18%; they said the metformin would bring it down.

I was waiting for my insurance to kick in starting January 2014 so I could meet with an endocrinologist, but I was feeling so badly, I went in on December 31, 2013. The endocrinologist officially diagnosed me with type 1 diabetes, but I only had 10 minutes of training—it was a whirlwind of 15 carbs this, 20 units that.

My blood sugar had been so high for so long that they had to bring me down slowly, meanwhile insurance was so hard to navigate to try to get the help I needed.

The initial learning process took about 18 months of feeling like I was in the dark, trying to bring my blood sugar back down (which no one warned me was going to feel horrible, after my body getting used to being in the 300s), and figuring out how to get covered for what I needed.

Health expenses

My current insurance is an HMO that has a $5,000 deductible, so I have to make sure I’m managing initial out of pocket costs every year.

My employer pays $380 per month of my premium; I pay the other $189. My current plan doesn’t cover blood sugar test strips for the type of meter I use. So before I had my Dexcom G6, I would just buy strips online. It was $140 for a 90-day supply, but it was cheaper than going through insurance or the manufacturer.

My initial insurance was hard to navigate. It was decent, but it was hard to figure out how to get it to cover basic items, like insulin. It took two months for them to figure out how to even file it. I would call supply companies and they would ask me, “are you sure you have type 1 diabetes?”

I wracked up a significant amount of credit card debt; I had to keep opening card after card just to get the medicine I needed to survive. I’ve had to default on some of those cards—it was either pay them off or pay for insulin—so my credit has taken a major hit, which doesn’t reflect who I am as a person.

Then my endocrinologist told me I needed to get an insulin pump, that it would be the best thing for my health. But I didn’t really know what that meant or what an insulin pump really did and I was trying to navigate so much on my own because I couldn’t pay for the healthcare that would have helped me learn.

My first insulin pump—a Medtronic 530 with Guardian CGM – was $2,500 out of pocket. There was no way I could afford it, so my mom and brother stepped in to pay for it.

The greater impact

Mentally, [being diagnosed] was taxing. There was so much information—there were times when I was first diagnosed that I would just break down and cry. It was so much all at the same time. You never stop thinking about it—am I dizzy because I’m high? Am I dizzy because I’m low?

For the first year or two I blamed myself, because I didn’t know that much about diabetes. I wondered if I did it to myself. It made me very anxious and put me into a pretty major depression. But I didn’t have any money to get therapy or help.

I was working to live. When I had a day off from work, that would be my day to chase down something—medical supplies, prior authorizations. It was so hard to learn how to take care of myself, and then I was trying to manage the logistics and costs too. It was too much at once.

Forced trade-offs

The big thing I’ve had to give up is ever buying a home. My credit tanked when I was first diagnosed and I’ll never recover. I’ll always be paying for diabetes. I will never catch up.

Just this morning I had a phone interview for a new job—I’m trying to find something that might give me some extra income. They asked me about my credit, and I had to tell them it was bad. They didn’t ask why. It disqualified me from the job.

What do you wish people understood?

I wish people understood that there is no other treatment. There’s no choice. I wish they understood that it doesn’t matter how much insulin costs, we’ll always have to buy it. And I wish they understood that insulin is not a cure, but a therapy. It is a constant in our lives. This is not a choice.

People are rationing, people are drowning in debt. Insulin needs to be affordable or free to the people who need it, but I’m not sure we’ll ever get there because there’s so much ignorance surrounding type 1 diabetes.

Read Part II and Part III in this series.

Editor’s Note: People who take insulin require consistently affordable and predictable sources of insulin at all times. If you or a loved one are struggling to afford or access insulin, click here.